Help Carter & Briella Melton

Attend a Christian School!

Your dollar-for-dollar tax credit donation makes Christian Education possible for our family.

Hello Friends and Family! Carter and Briella love Dream City Christian School. Carter is in 6th grade and enjoys learning Spanish, taking STEM classes, reading adventure books, and playing soccer at recess. He's also a member of the National Honor Society. Briella is in the 5th grade and loves chapel where she can worship alongside her friends. Both have enjoyed their teachers, and both have made the Principal's list or Honor roll.

Our family would like you to consider taking advantage of the Private School Tax Credit by recommending Carter and Briella to receive a scholarship, while you receive a dollar-for-dollar credit when you file your state taxes (If you live in AZ). If you don't live in AZ, it is still tax-deductible for you. We feel blessed that we get to send our children to this amazing school where they can grow in faith and academics. We certainly would not have this opportunity if it weren't for the generous scholarships we receive from ACSTO because of donations from our family and friends. Please let us know if you have any questions, and thank you again for your support! Matt and Holly Melton

On behalf of our family, thank you for considering this wonderful opportunity!

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

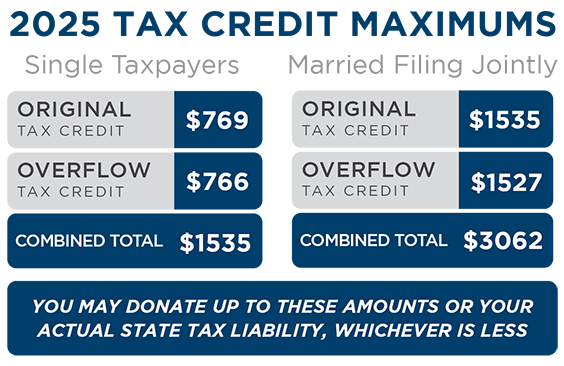

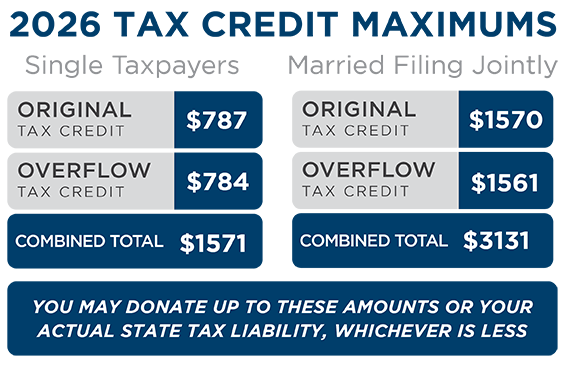

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.