Help Madelyn & Abigail Husa

Attend a Christian School!

Your dollar-for-dollar tax credit donation makes Christian Education possible for our family.

Madelyn and Abigail were both born in Arizona but raised as missionary kids in Papua New Guinea among the Mibu tribe. Their education began with homeschooling before they attended an international mission school. Upon returning to Arizona three years ago they integrated into a small local charter school. Madelyn has spent the last two years thriving at Valley Christian High School, where she has shown remarkable growth personally and spiritually. She is known for her creativity, particularly in writing and drawing, and has been diligently learning American Sign Language. Her strong friendships at school underscore her commitment to fostering meaningful connections.

Abigail, like Madelyn, is also creative and finds joy in drawing, but her true passion lies in baking. She aspires to pursue a career as a chef or baker in the future. Additionally, she enjoys music and sports, demonstrating a well-rounded set of interests. Both Madelyn and Abigail have made significant strides in their academic and personal journeys. Madelyn's positive experience at Valley Christian reflects her adaptability and resilience, while Abigail eagerly anticipates the opportunities for growth in a faith-based educational setting. We'd love to be able to continue to send them there where they get the type of education and support in areas that they need, both in faith and school. Would you consider giving toward their education there? We love the ACSTO program here as it allows people like you to be able to give toward their education at a NET ZERO cost to you!

On behalf of our family, thank you for considering this wonderful opportunity!

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

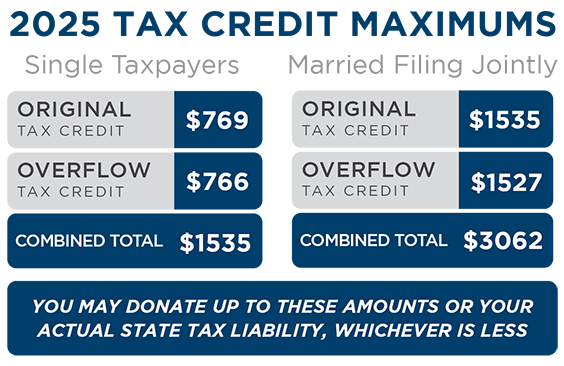

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.