Help Students at

Valley Christian Schools

Your dollar-for-dollar tax credit donation to ACSTO provides scholarships to students at

Valley Christian Schools.

- Updated.jpg)

Established in 1982, VCS provides nearly 1,100 students a distinctly Christian education with excellent academics, championship athletics, award-winning fine arts, cutting-edge STEM programs, and a supporting community. The mission of Valley Christian Schools is to equip students to be culture changers for Christ by delivering academic excellence, facilitating spiritual growth, and building lifelong community. Valley Christian is ranked as one of the Top 50 Christian high schools in the U.S., was named a 2025 Top Workplace in Arizona, and is the home of 84 state championships.

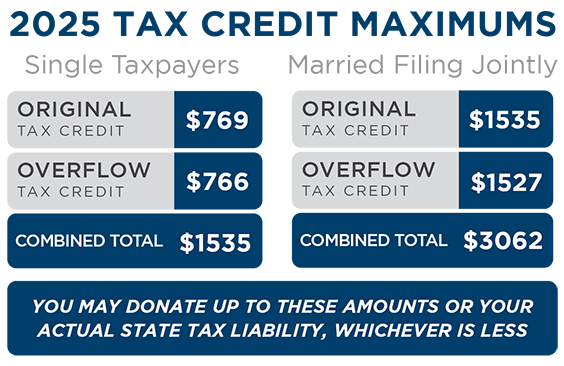

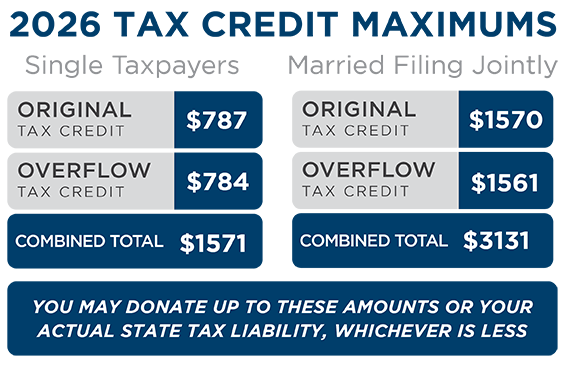

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.