Help Students at

Christ Greenfield School

Your dollar-for-dollar tax credit donation to ACSTO provides scholarships to students at

Christ Greenfield School.

At Christ Greenfield Lutheran School we value Christ, Quality, and Community. We provide a place where children can grow spiritually, academically, and socially in a caring environment where they are encouraged and challenged to reach their God-given potential. We go to the extreme for others to experience CHRIST. We do whatever it takes to provide exceptional QUALITY. We intentionally cultivate a Christian COMMUNITY.

CHRIST is our cornerstone. All things at CGLS are built on Him. When it comes to purpose, people, and programs, He is the way, the truth, and the life that we follow. We utilize the Christian Character Formation Project to guide our students through Biblical studies and character development with focus on seven core virtues: Courage, Diligence, Integrity, Justice, Respect, Responsibility, and Self-Sacrifice.

Your ACSTO scholarship donation makes all the difference in helping young families afford a Christian education. Please help us bring FAITH, LOVE and a STRONG Christian foundation to children of all ages, while you earn a dollar-for-dollar ACSTO tax credit. It’s a win, win opportunity for everyone. Thank you!

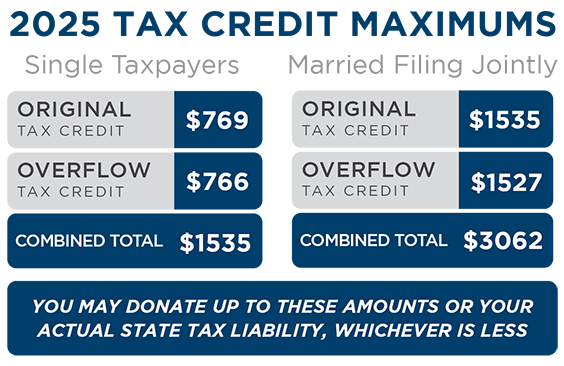

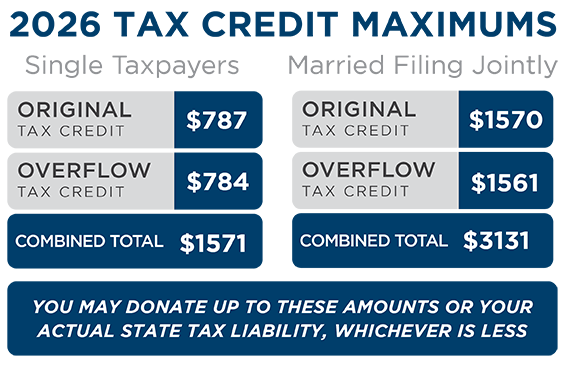

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.