Help Students at

Caritas Christian Academy

Your dollar-for-dollar tax credit donation to ACSTO provides scholarships to students at

Caritas Christian Academy.

Caritas Christian Academy strives to partner with parents by providing a Christ-centered education in the classical tradition that trains students to know, love, and practice that which is true, good, and beautiful. We endeavor to equip our students to live purposefully and intelligently in service of God and neighbor.

Caritas (CAR – ee – toss) is the Latin word for unconditional love. It is the love that God shows us; and since we are made in His image, it is the love that we should show one another. Our motto is “Caritas numquam excidit”—which means “Love never fails.” (1 Corinthians 13:8). Our school offers an education that begins with the end in mind—the formation of a whole human person, who will mature, flourish, and bear fruit in every area of life; whose path is more than school, college, career—but rather a full and worshipful life that includes work, family, community, church, culture, and service.

The cost of private education continues to be a barrier for many families seeking a Classical Christian education for their child(ren). Through our partnership with ACSTO, tuition scholarships increase affordability for our families. Please help us empower families to provide their children a quality education, while you earn a dollar-for-dollar ACSTO tax credit. It’s a win, win opportunity for everyone. Thank you for joining us in growing God’s Kingdom.

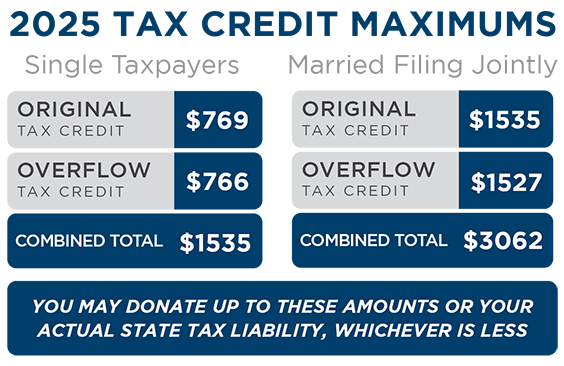

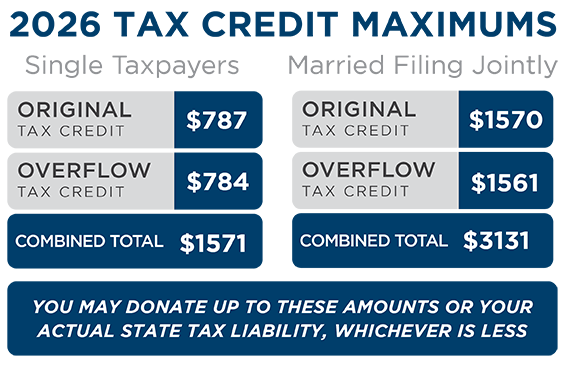

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.