Help Joshua Cornell

Attend a Christian School!

Your dollar-for-dollar tax credit donation makes Christian Education possible for our family.

Dear Family and Friends,

I pray this message finds you well and blessed. I wanted to take a moment to update you on the progress we’ve made with Joshua’s education and to share how God has been working in this process.

As many of you know, we've been working for a while now to make sure Joshua gets the best education possible. We love that Joshua is receiving an excellent education in a loving and nurturing environment, as well as developing skills to equip him to live in the world as we know it. The small class sizes, individualized attention, and curriculum that focuses on his strengths make all the difference. He’s thriving and it’s amazing to see his progress every year.

We’ve also been taking advantage of the Private School Tax Credit program, which has helped us with the financial aspect of Joshua’s tuition. It’s been such a blessing to have this opportunity to donate and recommend funds toward his education, and we continue to be amazed at how God provides. If you feel led to support this effort, we’d be so grateful. Contributions to ACSTO would allow you to help Joshua in a tangible way, while also benefiting from tax credits yourself. I can’t tell you enough how much it means to us that so many of you have been supportive throughout this journey. Whether it's through donations or simply checking in, it’s all made a big difference. If you're able to help again or want to learn more about how this works, just let me know—I'd be happy to fill you in.

Thanks again for everything. It’s been a big team effort, and we couldn’t do it without you!

Love,

Josh, Sara & Joshie

On behalf of our family, thank you for considering this wonderful opportunity!

As an Arizona taxpayer, your donation to ACSTO provides scholarships for students to attend Christian Schools while you receive a dollar-for-dollar tax credit against your state tax liability!

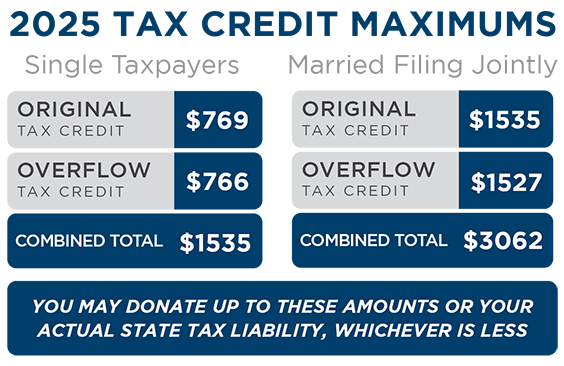

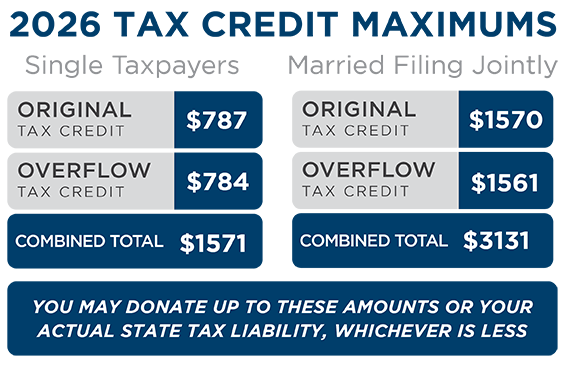

A tax credit is very different than a charitable deduction—rather than reduce your taxable income, it directly reduces your state tax liability (a.k.a. the tax you pay). This means that at the end of the year, if you normally receive a refund, you’ll get a bigger refund. If you normally owe taxes, you’ll owe less. It is to your advantage to participate in this program!

For example, if your tax liability is $1,000 and you make a $750 donation to ACSTO, your liability will be reduced to $250.

In addition, you can donate all the way up until Tax Day or before you file your taxes (whichever of these comes first), and still claim the credit for the previous tax year.

The best part? ACSTO uses your tax credit donation to award tuition scholarships to Christian School students attending one of our Partner Schools. You can even identify a school or recommend a specific student to be considered for a scholarship.

Thank you for making Christian Education affordable for thousands of Arizona families!

For further information, please visit ACSTO.org or contact our office at 480.820.0403.